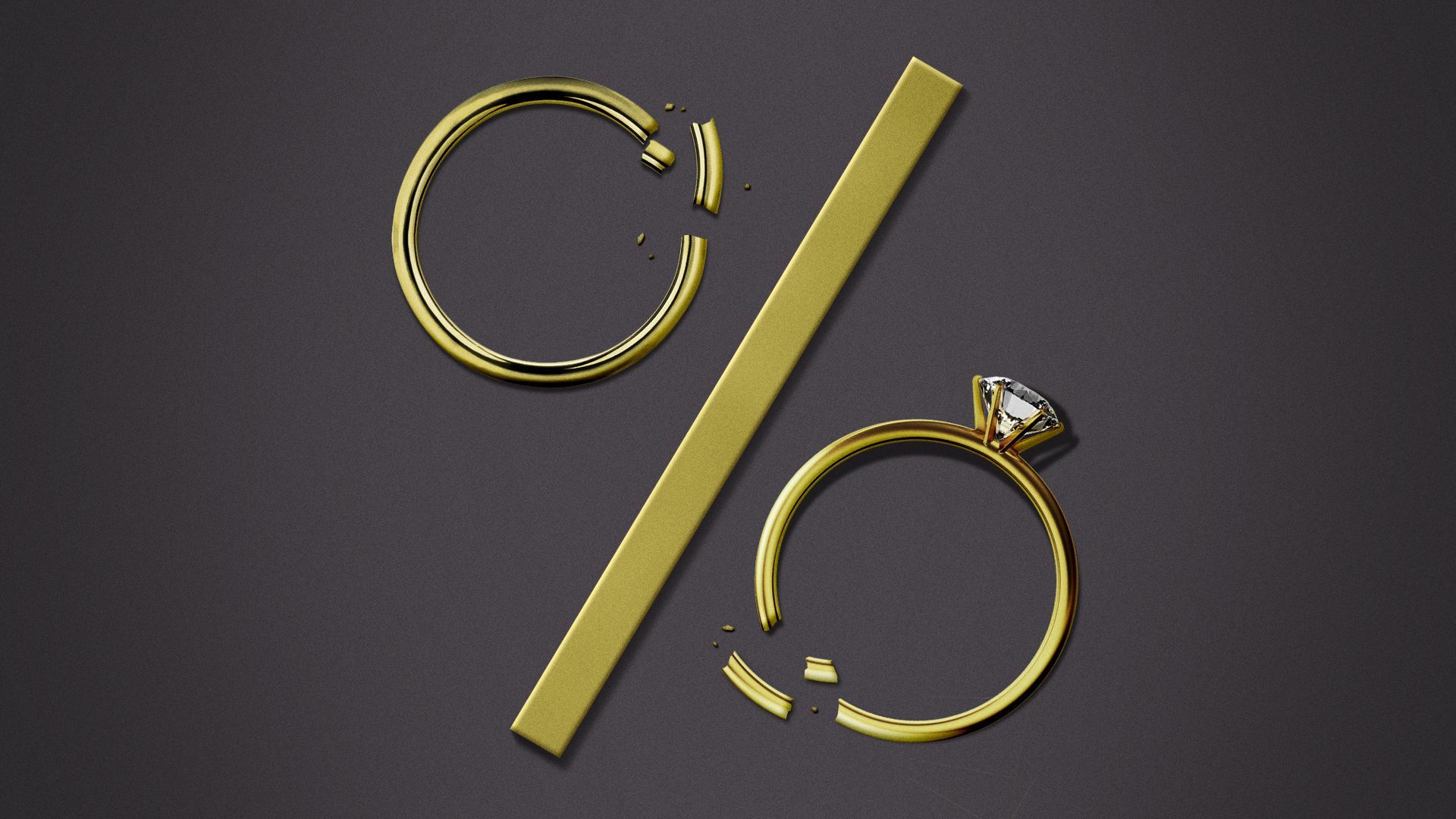

Divorcing Minnesotans are getting creative to blunt the blow of near-7% mortgages.

Why it matters: It's not just the ex causing heartbreak — homeowners around the country are loath to part with their low mortgage rate.

State of play: Higher mortgage rates can make the monthly payments unaffordable for one person, and tapping into equity to buy the other spouse out of their share isn't cheap, either.

- For many recent divorcees, refinancing the house or buying a new one could send their monthly mortgage payment soaring, according to the Divorce Lending Association.

Zoom in: Those refinancing or buying a new home after a split can apply for a shorter-term mortgage, since those rates are still near 6%, says Tom Meckey, who runs the lending division for a bank in Grove City.

What they're saying: While not for everyone, short-term loans can help when one partner plans to keep the house for a few more years — for example, until their kids are through high school, Meckey tells Axios.

- His bank also offers a bridge loan program that allows separating couples to buy new homes before they've sold their current home.

Between the lines: Minnesota couples are committed. The state has one of the lowest divorce rates nationally, Axios' Erin Davis reports from the latest census data.

The big picture: Some couples who split up are continuing to live together until mortgage rates fall, even if it means one of them moving into the basement, MarketWatch reports.

What's next: Others are turning to mortgage assumptions, a rare but growing way to take over someone else's home loan.

- Platforms like Roam and AssumeList aim to expand as homebuyers look for ways to snag a loan with a lower mortgage rate.

- Shoppers in areas where a high share of homeowners hold government-backed mortgages are more likely to see listings that offer a loan assumption, says Realtor.com analyst Hannah Jones, who notes most conventional mortgages aren't assumable.

0 Comments